Hello everyone!

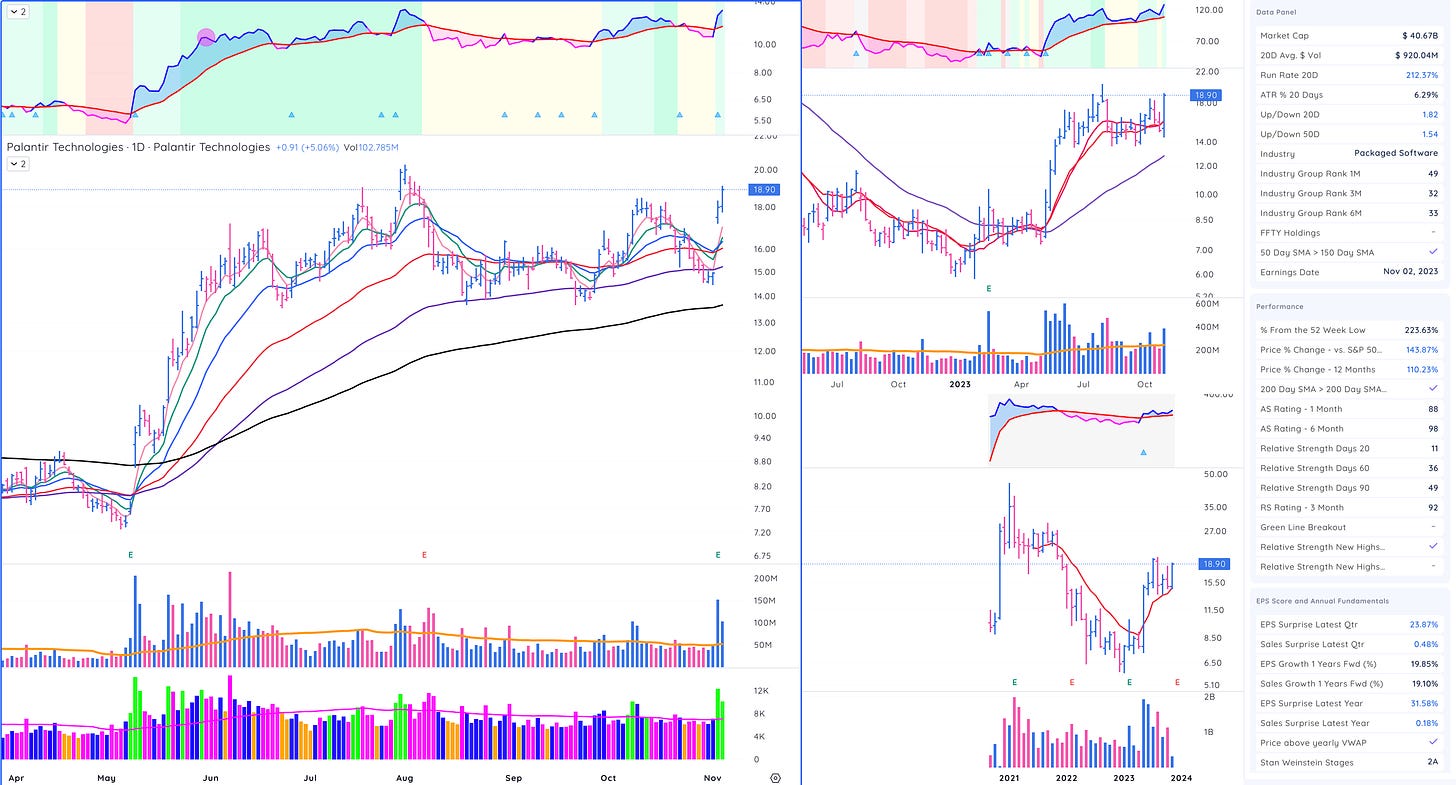

A lot of interesting things happened this week. While I try to avoid specifically talking macroeconomics, interest rates appear to be breaking lower (read: bond prices are heading up). The dollar also moved lower this week. As if on schedule, equities moved higher and the indexes staged an IBD Follow Through Day (FTD) followed by the second FTD. I’m not sure we could have wrote the script any better! With that said, those who maintained a running watch list of leading stocks to purchase got an opportunity to dip their toe in the water this week. I sure did with the purchase of, surprise surprise, PLTR 0.00%↑ .

Regular readers will note that I had previous purchased PLTR 0.00%↑ a few weeks ago and had gotten shaken out when it hit my stop. Not surprisingly, my second purchase was higher than my previous sell stop. So why sell it if I have so much conviction in the first place you ask? Well that’s which risk management is all about. There’s a few ways to look at it. All of risk management could be boiled down to position sizing. I tend to size my positions quite large. It's not unusual for my to have my entire trading account in three or four stocks. To ensure I can survive to invest another day, before I enter positions, I determine how far i’m willing to let the position go against me before I sell. That way I am mentally prepared for either outcome and can remain emotionally neutral as the stock moves. As I plan to play this game a really long time, my default state is to survive and not let my conviction in a stock supersede the price action. Any stock that’s a few percent points below my cost is a stock I do not want to be invested in as the market is telling me I am currently mispositioned. If the market does not confirm my convinction in a stock I am more than happy to sell and await more information. That more information came this week as PLTR 0.00%↑ made higher lows and higher highs on above average volume which as per my rules required me to buy it back.

My watch list is as follows. The tier 1 stocks are my primary focus and are near actionable. Tier 2 list has some flaws or i’m awaiting more information to determine whether they will lead the market during the current rally.

Tier 1

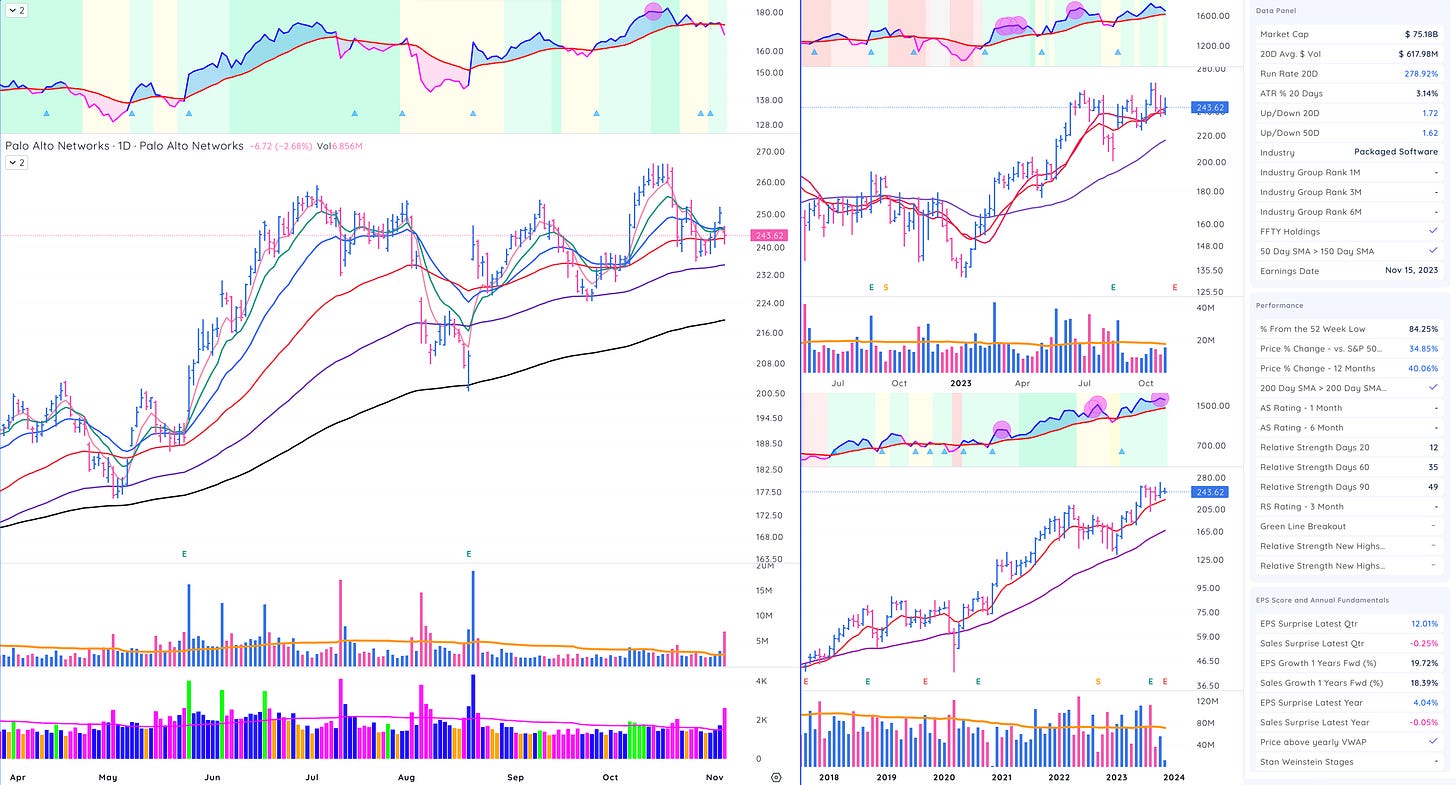

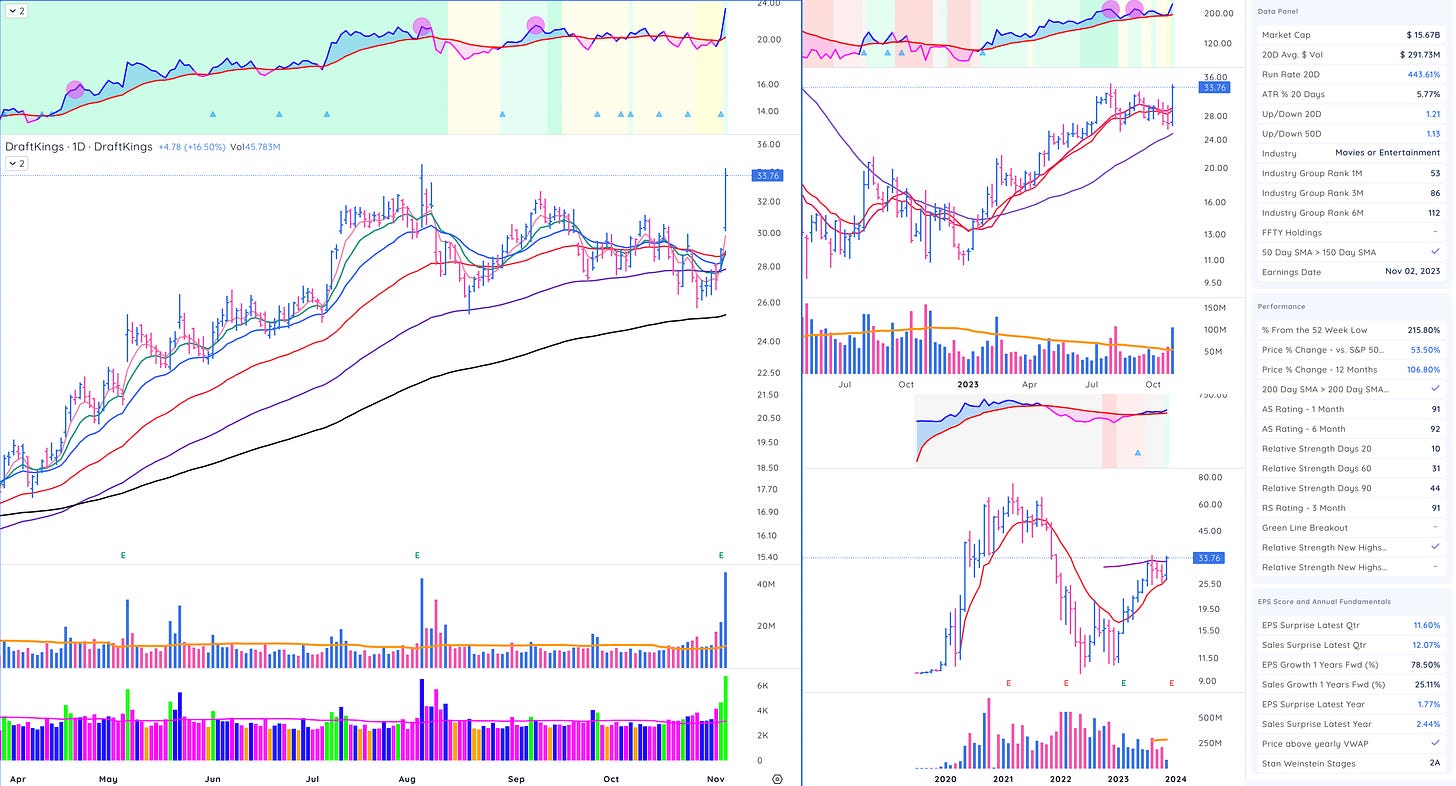

PLTR 0.00%↑ , ANET 0.00%↑ , NOW 0.00%↑, NVDA 0.00%↑ , MSFT 0.00%↑, PANW 0.00%↑ , MELI 0.00%↑ , AMZN 0.00%↑ , DKNG 0.00%↑

Tier 2

TSLA 0.00%↑ , LI 0.00%↑ , COIN 0.00%↑ , IOT 0.00%↑ , MDB 0.00%↑ DECK 0.00%↑ , ONON 0.00%↑ , VRT 0.00%↑ , CELH 0.00%↑ , CCJ 0.00%↑

I touched upon PLTR 0.00%↑ in the last post so I will try to quickly analyze the other Tier 1 stocks and why I like them.

This was one of the the very first institutionally liquid stocks that had a breakout into all time highs before the indexes staged a follow-through day. Earnings and sales growth speaks for itself. It’s part of the AI theme in providing software and hardware for cloud and data centers. Volume on the breakout was strong. The one wrinkle I see is that it does not have strong industry group peers to confirm broad strength but given its $66 billion dollar market capitalization, i’m willing to give it a shot. I’d like some tightness while short term moving averages catch up and look for an entry.

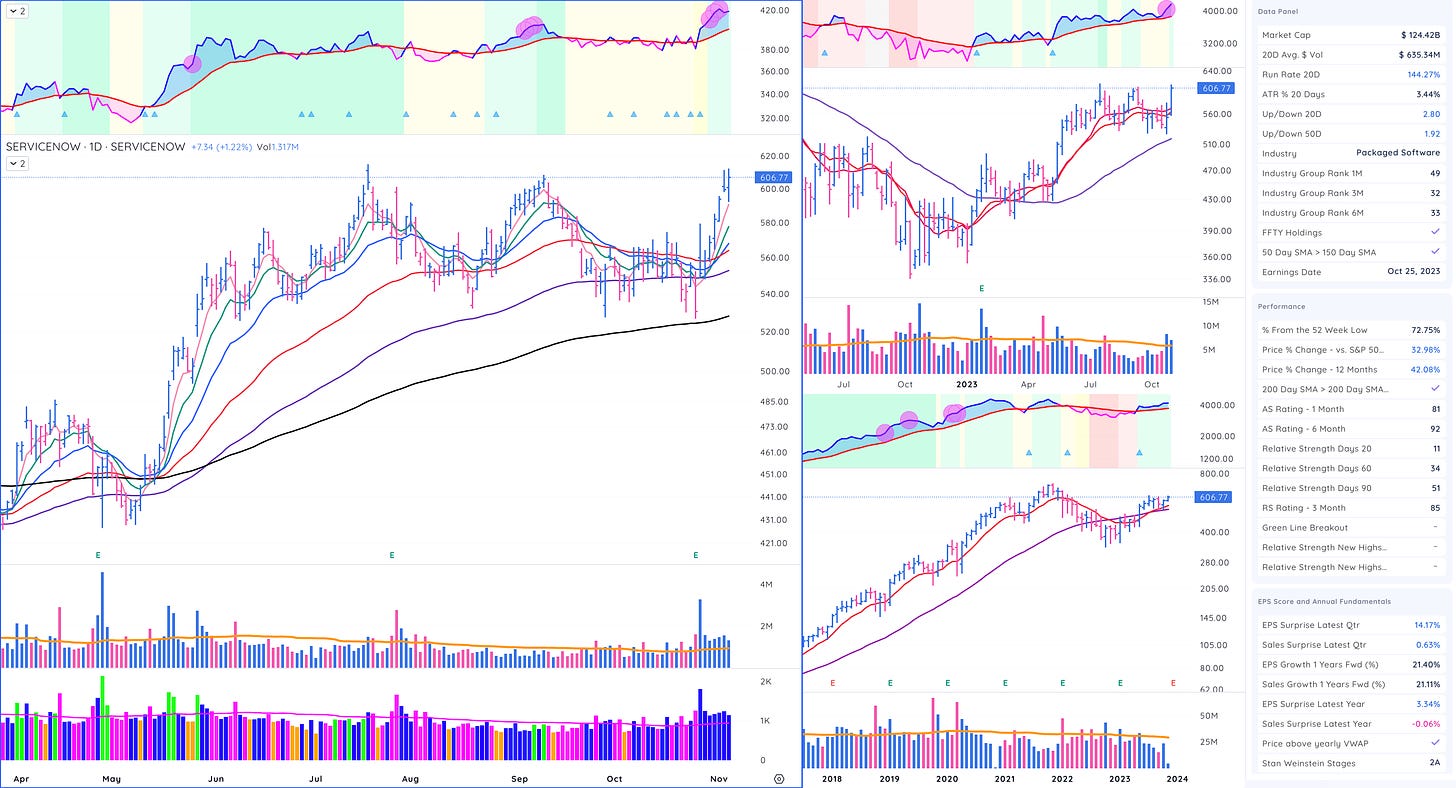

This was a sleeper pick that surprised me. Traded sideways while the indexes were testing lows the last few months and now almost at all time highs. I think this is an institutional quality software stock. The earnings and sales are solid and consistent. Volume is solid and up seven days in a row! That’s strength up the right side of the consolidation. Same here, i’m looking for some tightness sideways as the short term moving averages catch up for an entry. I have a feeling though that this stock is going to blow through new highs without a digestion and will make me chase. I won’t chase much higher but would be a buyer of strength at all time new highs with a tight stop based on my position size.

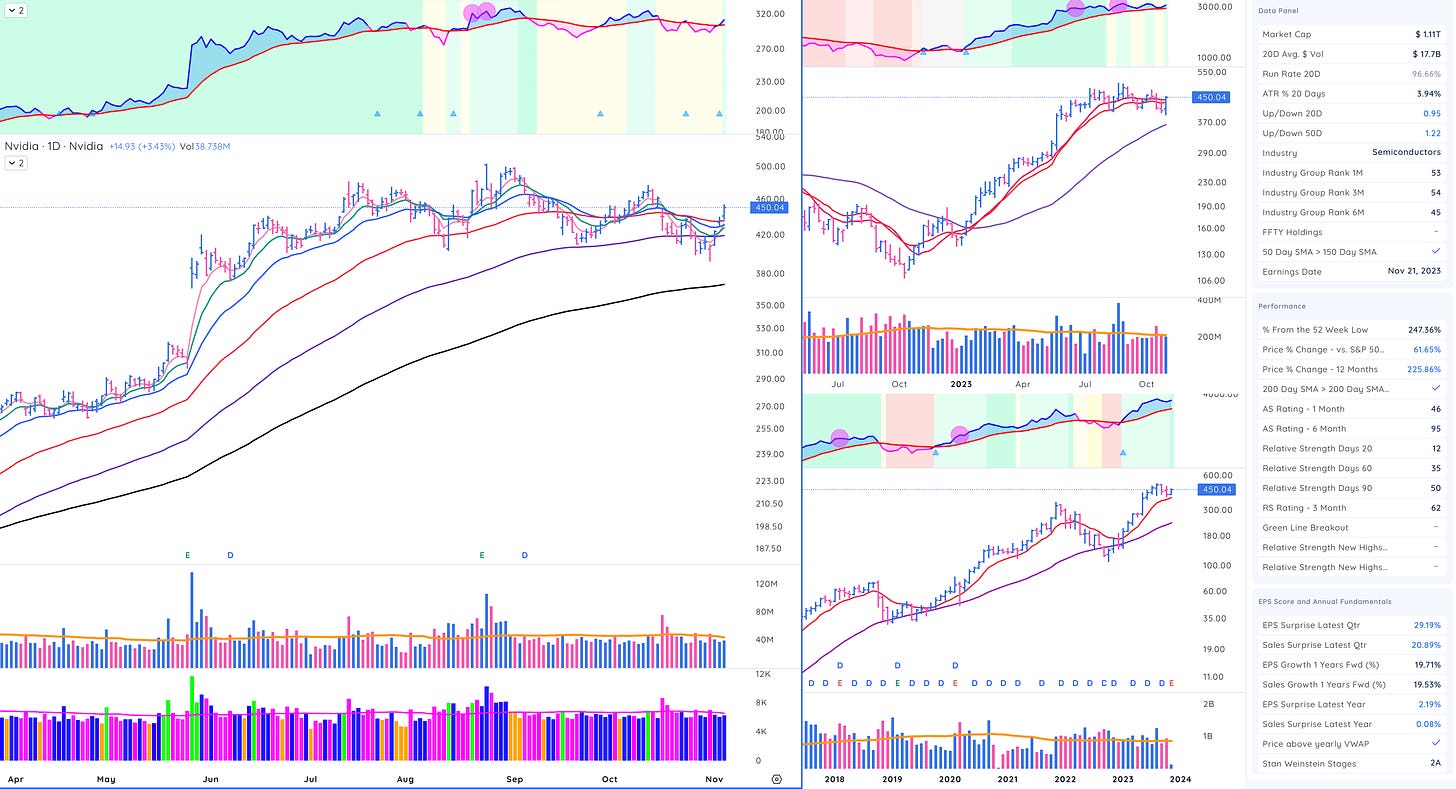

The stock speaks for itself. The picks and shovels pick of the AI trend. Amazing relative strength and sideways consolidation. Continues to find support at the $1 trillion valuation. The earnings beat and forecast last quarter was unreal. Like a broken record, I’d like some tightness sideways while the short term moving averages catch up for a low risk entry.

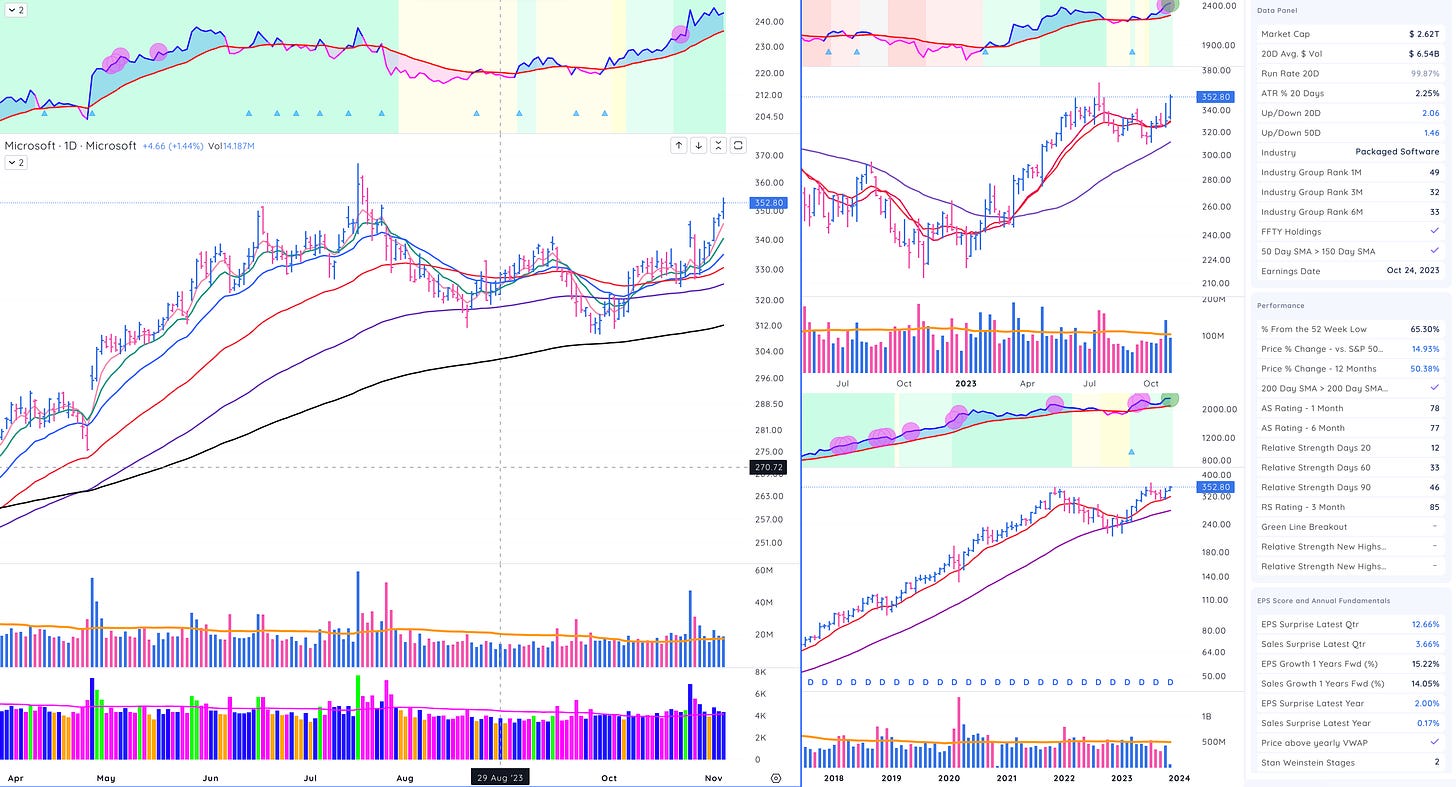

This was another stock that surprised me with its strength until I realized it is THE thematic large cap stock. Andrew Rocco at the bluesky event reminded folks that it has its hands in AI and the energy revolution. Sounds silly but this could be the sleeper large cap pick of the year! But alas we need some tightening sideways to buy into!

Cybersecurity is thematic and PANW is the large cap leader. Could be argued that this was the first early breakout of this potential uptrend but the pullback to the 50D came in on above average volume so that’s a red flag. The market could be waiting for earnings on the 15th to make the next move. It’s one to watch on a buyable earnings gap up.

Latin America’s Amazon? Numbers look good and strength up the right side of the consolidation is strong. I like the tight trading action compared to its history on the weekly and monthly. Sideways consolidation for an entry would be ideal.

Online sports betting seems to be picking up steam. The market seems to like the most recent earnings numbers. A bit of a dark horse in the Tier 1 group but again strength up the right side on volume. Small starter if Friday’s close holds and moves higher would work.

That’s all folks. Now’s the time to put in the work and get positioned properly if this rally has legs and moves higher from here. Ideally, we consolidate sideways and punish chasers this week but it will be on a stock by stock basis. I wouldn’t rush in here as we are still early on this rally and the jury is out on whether it lasts.

Play your game.