Welcome all,

It seems like we are entering the wall of worry phase with everyone pointing to bullish sentiment and high NAIIM readings as reasons to take gains and prepare for a correction. I have no idea when we will get a correction and I have no interest in trying to predict it. As the trading greats always say, I follow the price action of leading stocks and those in my portfolio (which hopefully are the same) for clues as to when to sell and nail down profits. Alas, I see very few sell signals for my system and style so i’ve been trying to sit on my hands and where possible rotate my capital into the very best stocks.

For those keeping track at home, i’m back into COIN 0.00%↑ ! If you guys remember, COIN 0.00%↑ was one of the very first stocks I bought in this current uptrend and proceeded to get shaken out right before doubling. I kept it on the watch list and it reset and pulled back into a consolidation. I learned my lesson from the first trade and keep much wider stops which resulted in a very small position size. I was channeling my inner Jesse Livermore and simply watched it go up 60 points as it rounded out the right side of the base and had an earnings gap up. I was waiting for some digestion to leverage my low cost position and really size up. I got that on 2/26 and its never looked back! Next step? Sitting. I think it was also Livermore who said, the big money is made in the sitting and I intend to precisely do that! COIN is the institutional leader in the crypto space with the “picks and shovels” approach that brings bitcoin to the masses which I also like technically.

With the success of COIN, I gained further confidence in some of my earlier picks such as PLTR 0.00%↑ but just couldn’t gain traction. I still think it’s going higher, but the personality of the stock just doesn’t suit me and the software space has had quite a bit of earnings blowups so it’s not the strongest trend. Maybe we are still too early in the trend for PLTR so I sold out with some paper cuts.

We seem to be rotating across groups as mega cap tech seems to be taking a breather and NVDA 0.00%↑ making fools of the pullback crowd and digesting sideways. Commodities seem to have woken up as a group and put in some interesting breakouts. I have some starter positions in HMY 0.00%↑ , SCCO 0.00%↑ , STLD 0.00%↑ and will look to see how they play out. We are early in that trend so I’m not expecting them to go straight up but if this commodity bull market has legs, those low cost positions will provide the buffer to size up and go for the jugular later in the rally so i’m being patient with these.

Another trend I am keeping an eye out for is the broading AI trend. Old stocks like DELL 0.00%↑ IBM 0.00%↑ and ORCL 0.00%↑ are starting to seem interesting. While i don’t think they are my style of stocks, others like MU 0.00%↑ certainly have my attention and have made it to my short list of watch and stalk stocks.

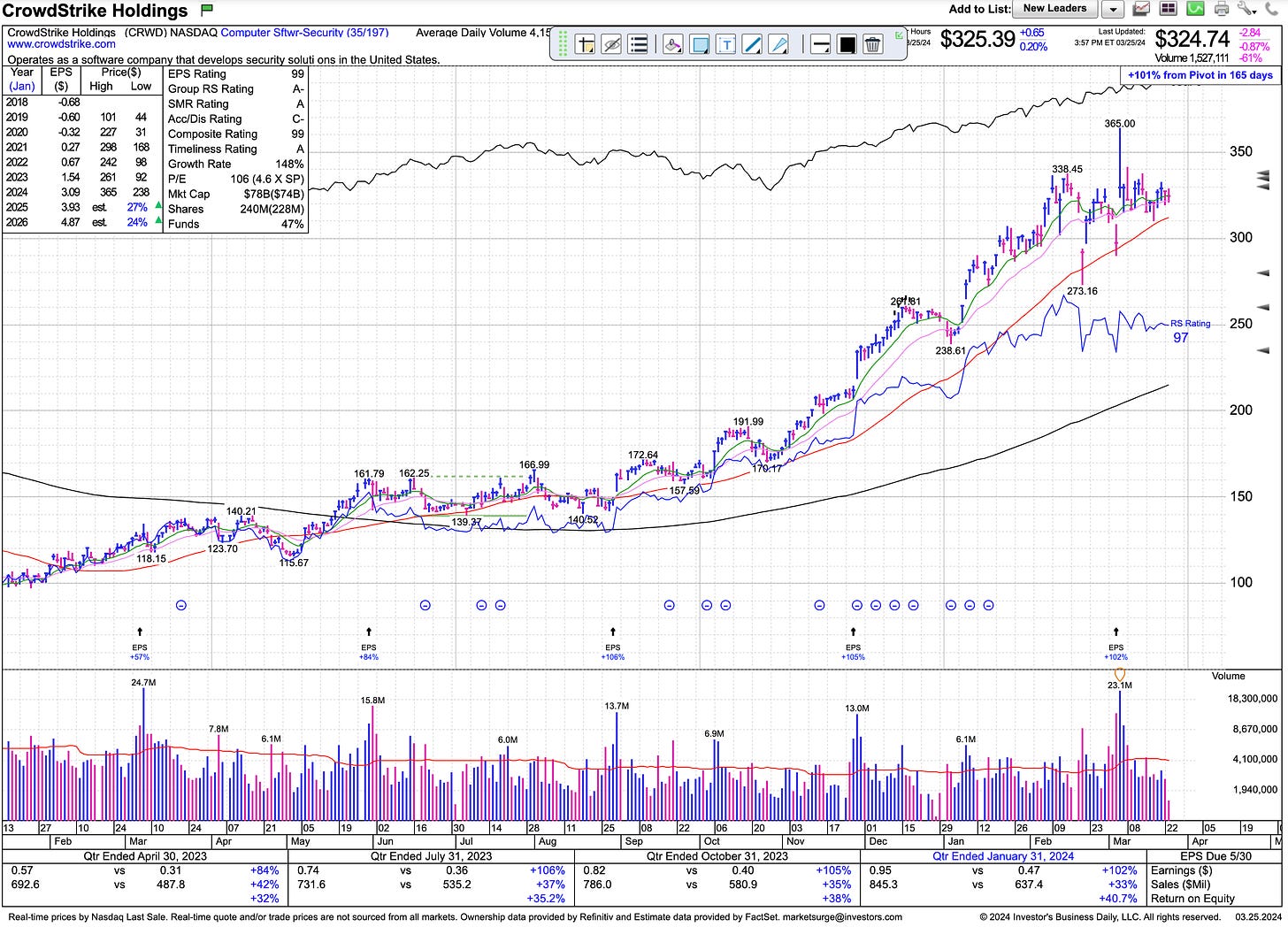

The play that has my attention the last few days is CRWD 0.00%↑ , its gone sideways for six weeks and while the beginning was volatile, its certainly tightening up nicely with support from short and intermediate term averages. If you turn to the weekly you will see that this is the first pullback since breaking out to all time highs. You will also notice volume is drying up and triple digit earnings growth the last three quarters. A breakout above $330 has my attention and a breakout on volume above $340 has all my available cash and any pennies beneath the cushions.

P.S. I’d like to thank Jason for the positive nudge on posting more! For those who haven’t yet, go sign up for his substack, Against all Odds, linked below. He’s a vet and shares a ton of high quality work!

Until next time folks! Stay on process and tune out the noise!